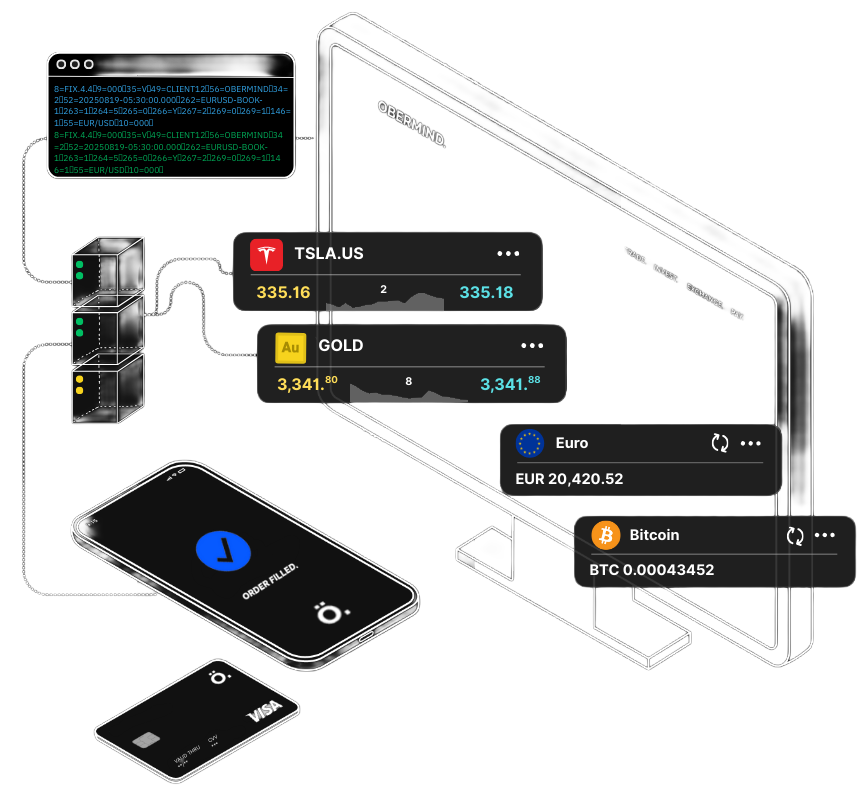

Obermind’s full-stack technology empowers startups and global institutions to build custom fintech platforms.

FX. CRYPTO. FUTURES. OPTIONS. CFDs. PERPS. SPOT. SPREADS. COMMODITIES. SYNTHETIC PRODUCTS.

PERFORMANCE

A financial operating system built for the modern enterprise.

Trade, transfer, swap, clear and settle anything in real-time.

150

1200

7000

300

40

750

Your proprietary platform.

Say goodbye to bloated middlewares, off-the-shelf white-label products, and patchy in-house hacks.

ENTERPRISES RUNNING ON OBERMIND

- Crypto Exchange

- FX/CFD Broker

- Futures Trading Platform

- Equities Broker

- Derivatives Trading

- Proprietary Trading Firm

- Managed Accounts

- Portfolio Manager

- Hedge Fund

- Algorithmic Trading

- Quantitative Research

- Digital Bank

- Card White Label

- Payments Processor

- Custodian

- Prime Broker

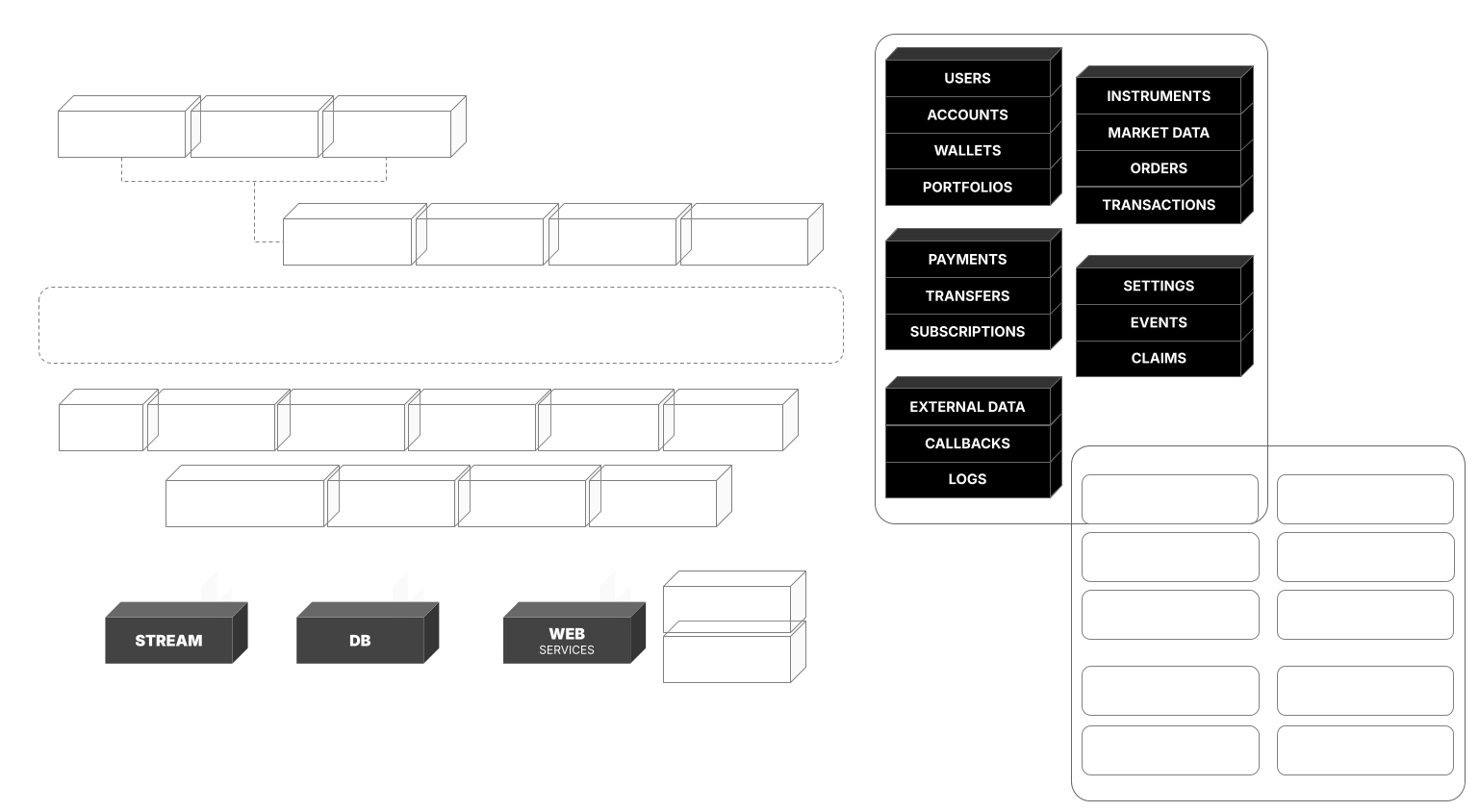

Modular Infrastructure for Every Fintech Use Case.

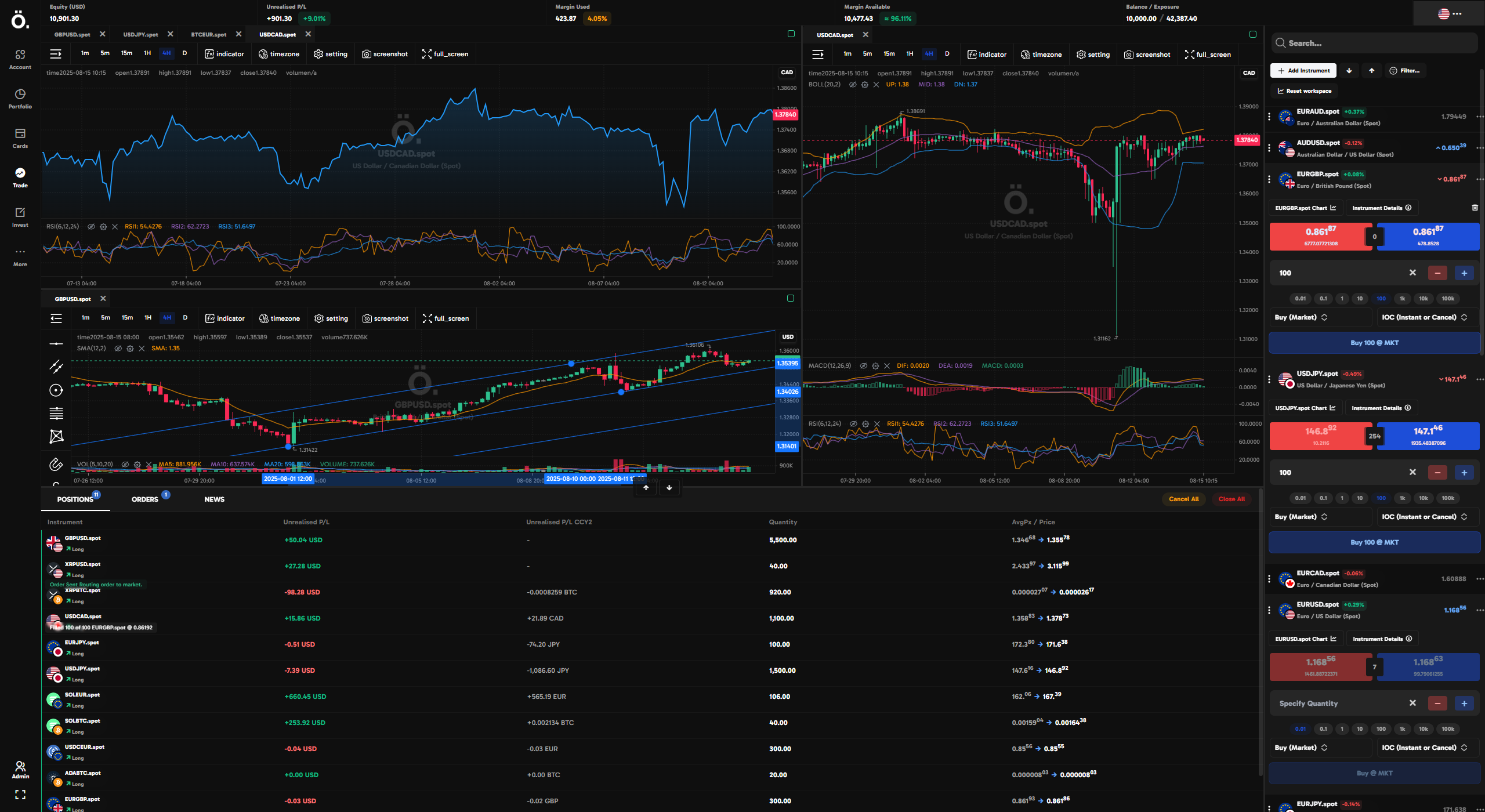

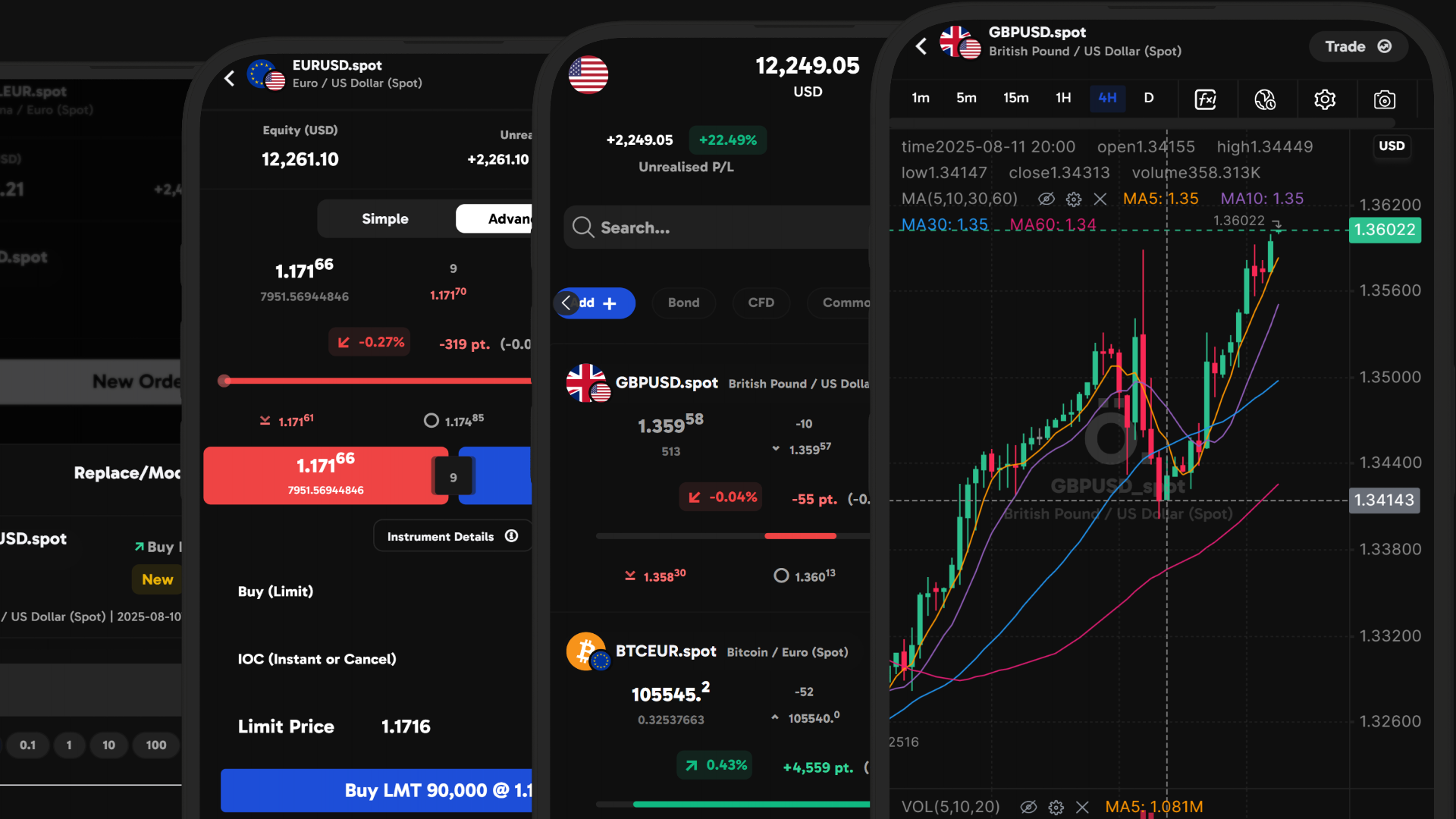

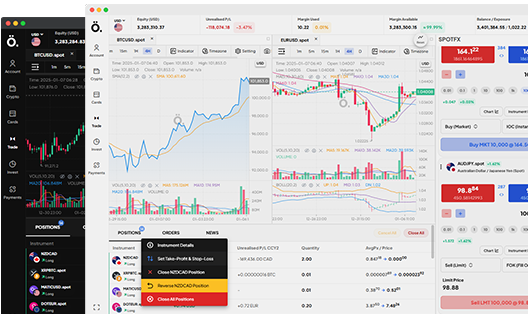

Brokerage & Trading Platforms.

From marketing and onboarding to KYC, multi-asset connectivity, payments, risk management, reporting, and multiple UIs and APIs — the Obermind Platform powers the full stack for digital and traditional finance brokers worldwide.

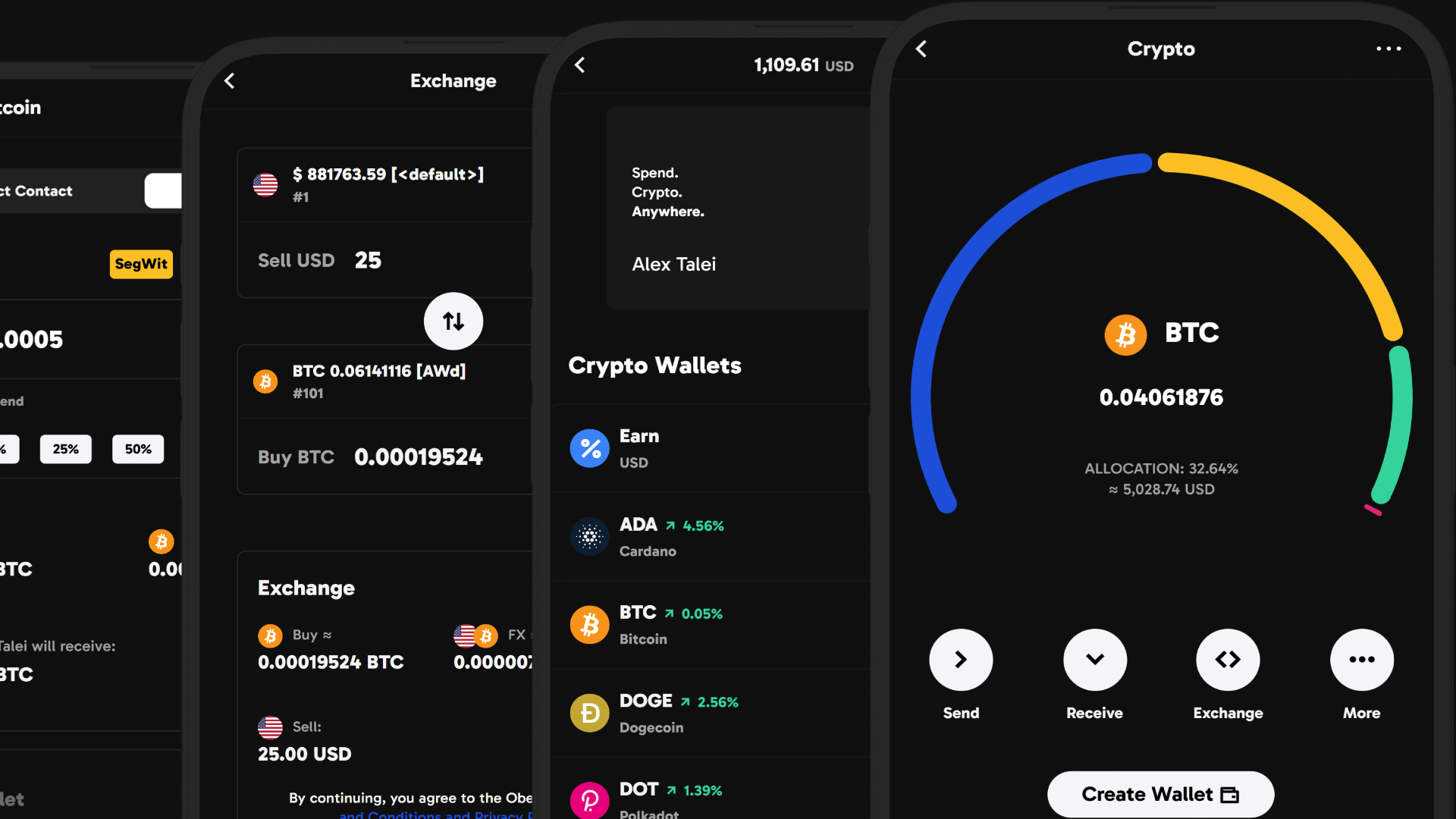

Digital Asset Infrastructure.

Launch crypto exchanges, payment services, tokenised assets, decentralised exchanges, or Wallet-as-a-Service — Obermind has done it all and gets you live fast with proven infrastructure and end-to-end support.

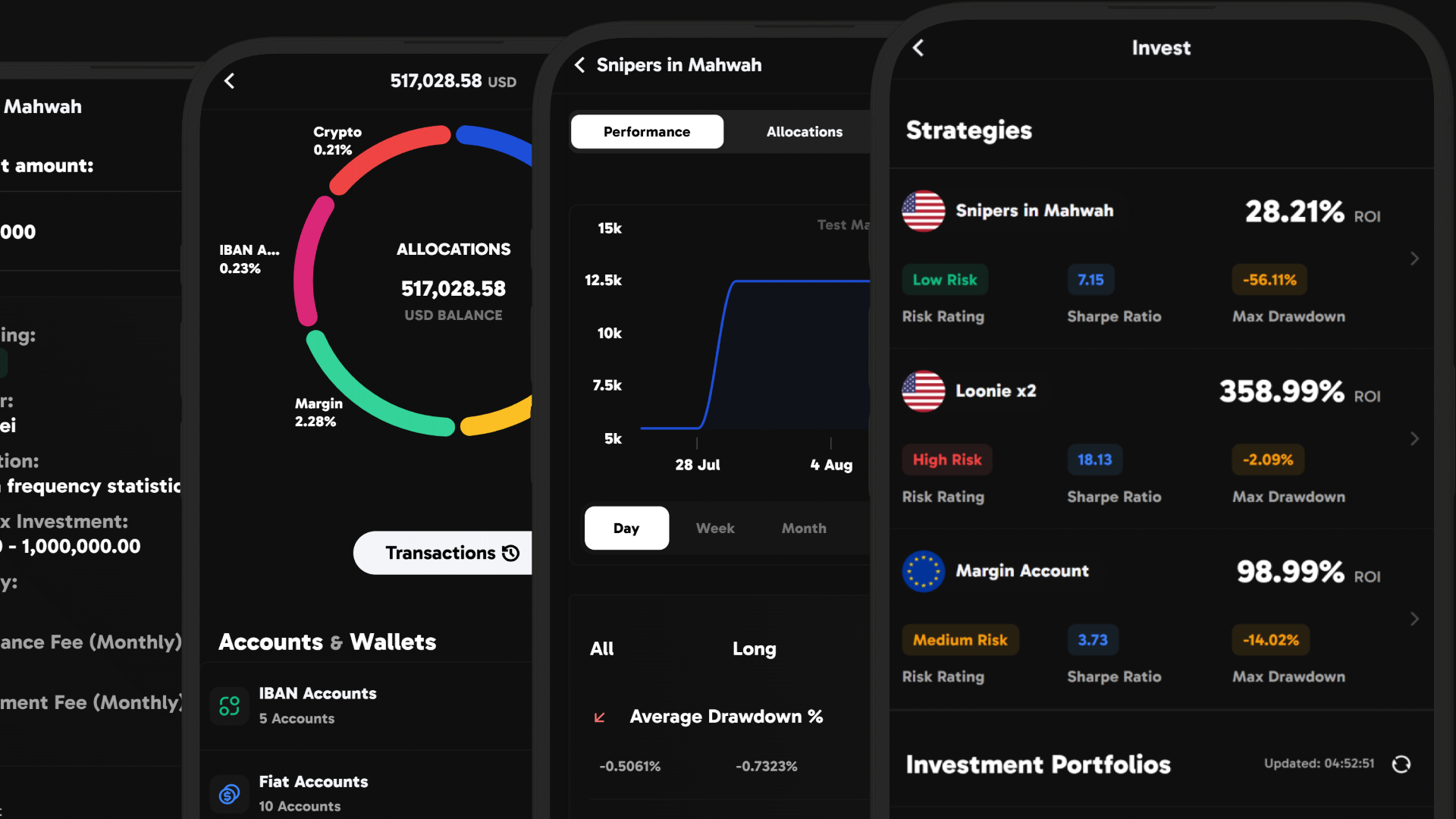

Portfolio & Wealth Management.

Deploy Obermind’s algorithmic and quant research tools for multi-venue hedge funds or CTAs, or deliver a complete WealthTech or Social Trading platform with automated allocation models — any portfolio management use case, fully covered.

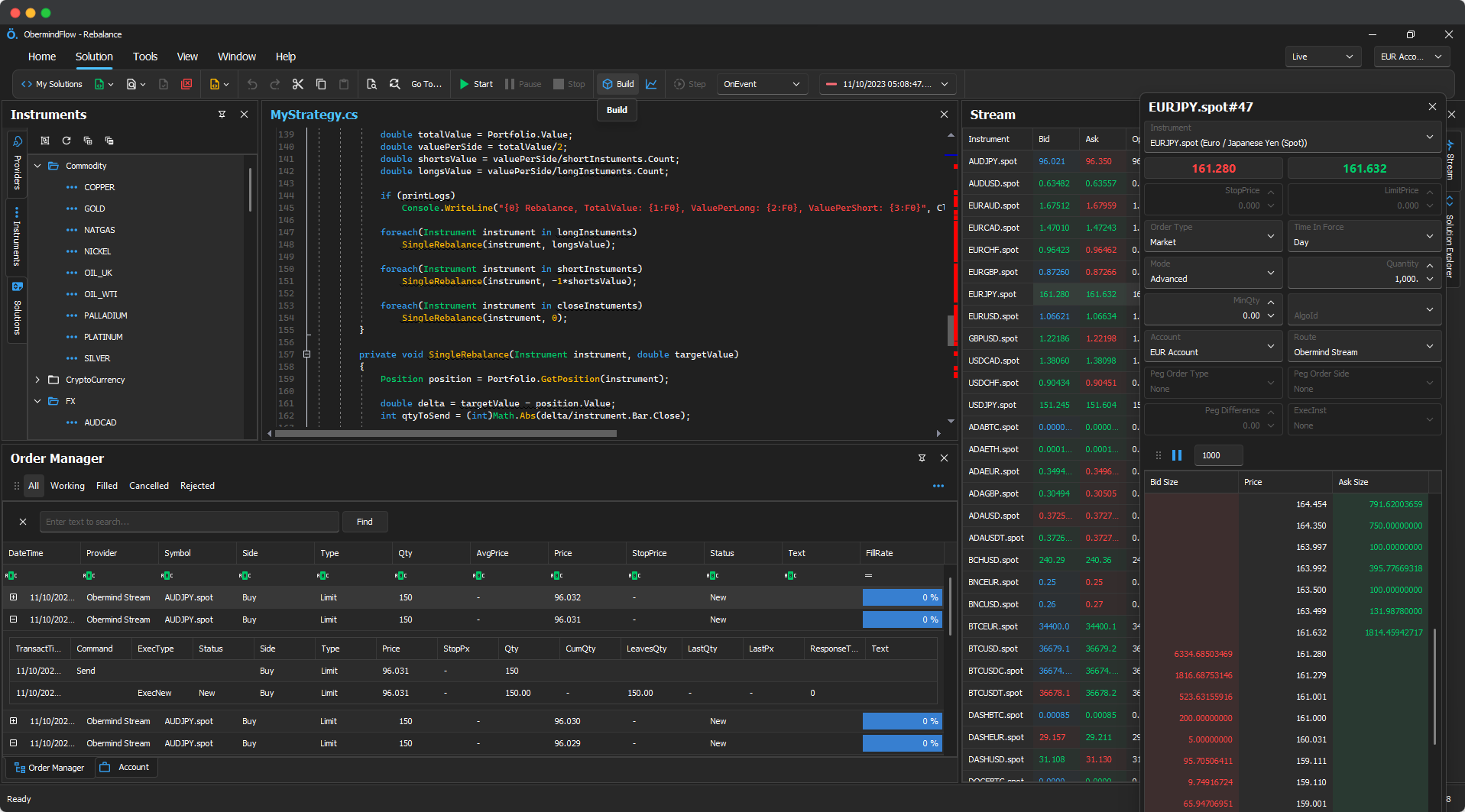

Quant & Algorithmic Trading.

Use Obermind Flow IDE or your preferred environment with the Obermind Framework to backtest, simulate, optimise, and deploy buy- and sell-side algorithms at scale — faster than ever before.

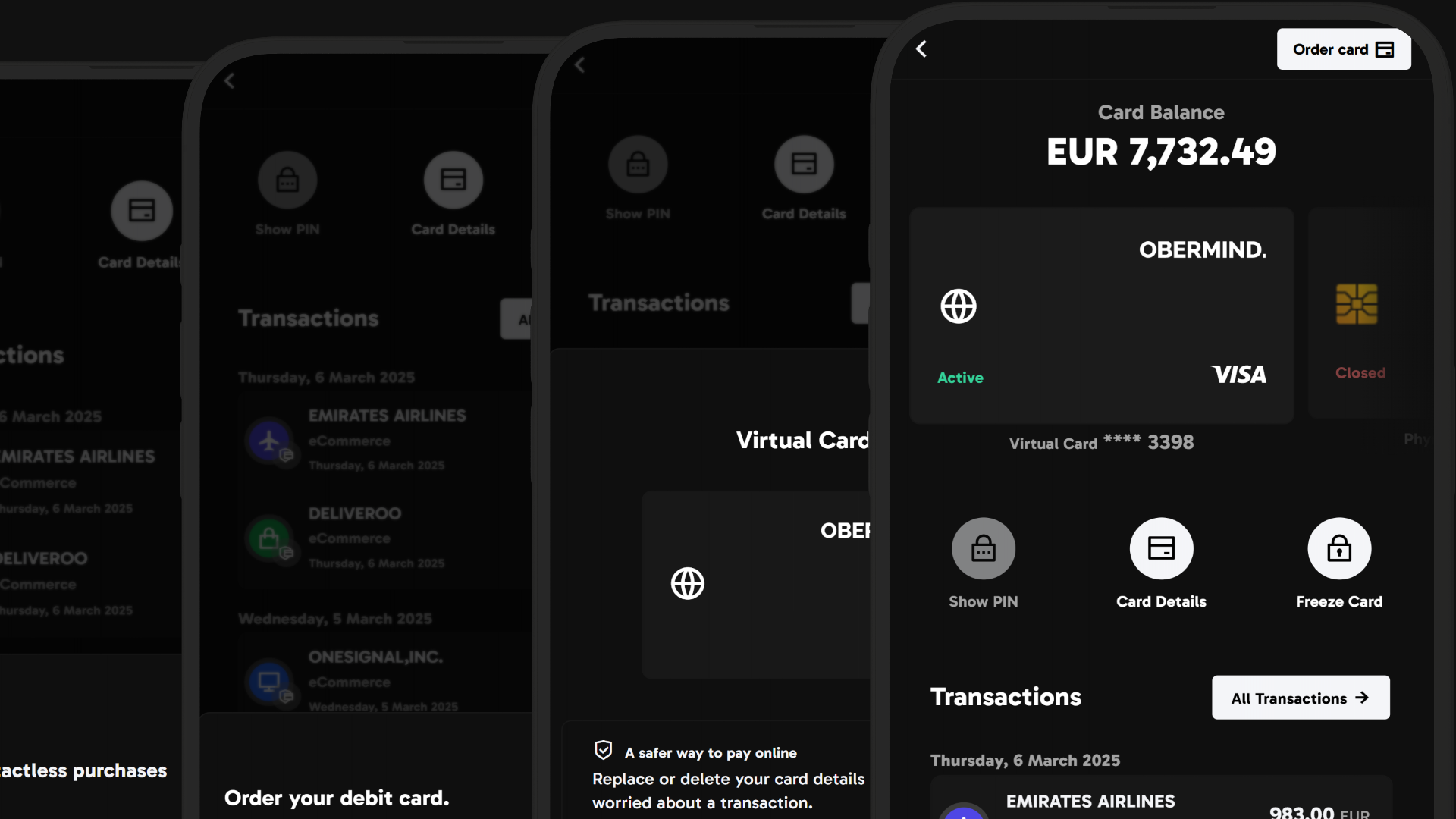

Card Issuing & Settlement.

Obermind’s White-Label Card solution enables rapid launch of branded virtual and physical cards. Our robust settlement infrastructure supports secure balance management across wallets and accounts in any currency — digital or fiat.

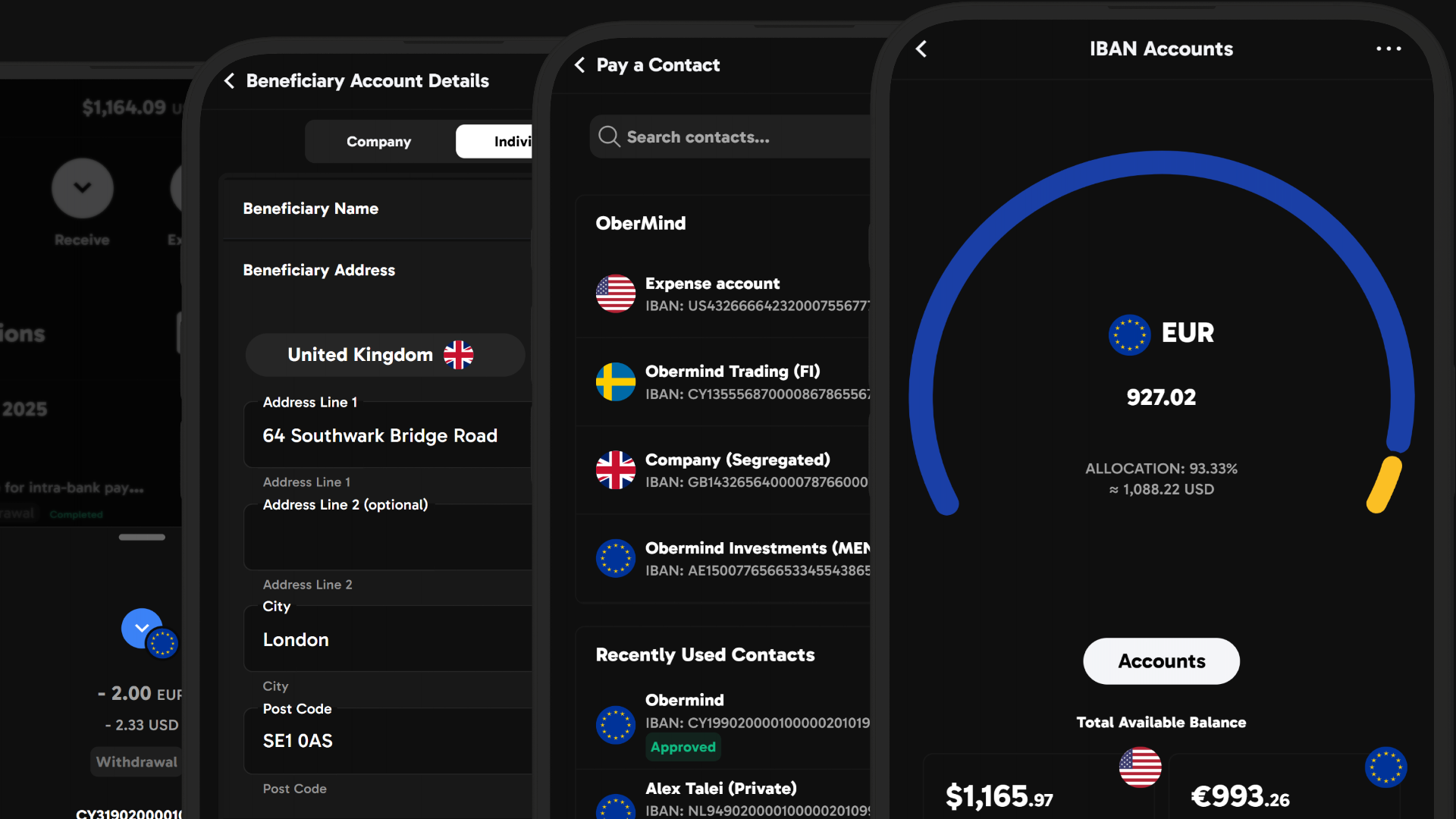

Digital Banking & BaaS.

Integrate Obermind’s BaaS into your existing stack or launch a full-scale neo-bank. Issue IBANs and SWIFT accounts, enable global and P2P payments, and manage seamless on/off-ramp operations across digital and fiat currencies.

Fintech Builders & Startups.

Build or scale your fintech on Obermind — spin up services, apps, and APIs in minutes, or plug into our modular infrastructure to extend your product stack effortlessly.

Our API-first, compliant architecture lets you launch and scale fintech products fast — without reinventing the wheel.

Market Data & Aggregation.

Real-time, high-throughput market data sits at the core of Obermind.

Consume, store, aggregate, and distribute anything — from tick data to Level 2 depth. Manage terabytes of time-stamped historical data, and deliver customised analytics at scale.

Beyond White Label.

From branded apps and app store listings under your company name, to branded cards, API documentation, custom sell- and buy-side algos and source code license – we mean business.

Obermind’s modular architecture enables us to customise products and features to match your requirements and regulatory regime while adding unparalleled value to your fintech.

Your brand.

Custom skins, layouts and features. Every item built to match your brand.

Pixel perfect design.

Custom-design components, styles basically any UI element to match your brand.

Ready to deploy.

6+ purpose-built client and server financial applications – ready to scale on our managed infrastructure or your premises.

24/7 Support.

Whether we develop, host or manage the full-stack for you – we are always just a message away.

Powerful API libraries.

Use our multiple APIs, custom-built for fintechs to launch, consume and distribute globally while achieving the flexibility, performance and agility required for mission-critical systems.

FIX API

Maker & Taker

WebSocket

Market Data, Orders and more.

REST API

User & Admin

INTEGRATIONS

Seamless integration.

Ready-made integrations with a wide array of exchanges, liquidity providers, payment gateways and infrastructure providers + a host of SaaS providers to automate your enterprise resources.

Secure and Compliant.

Obermind makes meeting regulatory and cybersecurity standards and requirements a walk in the park.

Financial Infrastructure.

Purpose-built architecture. Ready to power the most demanding fintech businesses.

Enterprise Ready.

No more reinventing wheels, wasting time and resources. Everything you need to power your enterprise securely and compliant.

Authentication

Apply ADM (Advanced Device Management), MFA (Multi-Factor Authentication) and SCA (Strong Customer Authentication) to secure and protect users.

Comply with the most demanding Information Security standards (e.g. FIPS 140-3) and regulatory (e.g. PSD2) requirements.

API

Create, publish, maintain, monitor and secure custom REST API, Websocket API, FIX API (Financial Information eXchange) and binary API gateway for interoperability with Obermind’s latency-reducing technology.

Create custom end-points for connection to your platform or connect and integrate with existing and new third-party APIs fast and securely with Obermind Platform.

Biometrics

Cross-platform Fingerprint, Face ID or Touch ID authentication.

Enhance user experience and security with Obermind Biometric and Obermind ID Verification modules.

ID Verification

Comply with local and global Know-your-Customer (KYC), Due Diligence and Anti-Money Laundering (AML) regulations using Obermind ID Verification automations.

Require face scans using 3D facial recognition on fraud detection or comply with on-going AML requirements, no use-case or workflow will be a challenge.

Payments

Accept or issue Cards, Bank (Direct Debit, SEPA, BIC), mobile payments (Google/Apple or custom NFC) or cryptocurrencies. Obermind Payments automates and simplifies the task of building global payment networks to receive, send and process payments.

Real-time valuations, conversions, auto-hedging and settlement capabilities built for Fintech, financial institutions and e-commerce enterprises.

Singe Sign-On

Deploy single sign-on across all platforms without compromising on security.

Enable users to securely sign-up and log-on on any device with their ID provider. Connect and authenticate with Microsoft, Facebook, Google, Apple, X, Github and more using Obermind SSO.

Reporting

FCA, MiFID II, MiFIR, EMIR, KYT (Know-Your-Transaction) drop-copies, trade reporting to SDRs or any other reporting requirements your business falls under can be automated with Obermind Transactions.

Relational or time-series data reporting jobs are automated and done in batches or real-time with Obermind Transactions, ensuring compliance with international legal, regulatory and security requirements.

CRM

Manage your Users and Data with Obermind Admin and Obermind Dash. Complete overview of User data, from devices, locations, payments, transactions, logins and KYC data to documentation, agreements and images.

Manage users, roles and permissions with ease and sync structured real-time data to enrich third-party applications (e.g. marketing, accounting, reporting).

ERP

Automate processes with extensive structured data and connectivity. Produce detailed transaction statements, reports, approvals and more to achieve a complete and trusted overview of your business.

Manage users, roles and permissions with ease and adopt new business models and processes rapidly with Obermind Workers and Integrations.

White Label

Provision new White Label trading and fintech apps with ease for your multiple entities or B2B customers. Create new brands and build custom cross-platform applications and features for Web and Mobile in days.

Powerful and simple no-code solutions enable you to deploy multiple branded and custom applications to meet B2B, multi-jurisdictional and partnership business models and requirements.

Compliance

The modern enterprise and financial institution with a global customer-base must comply with an array of legal, regulatory, Information security and Cyber security requirements and policies.

Obermind Platform provides the tools, integrations and know-how to ensure your platform, data and business are protected and secure so you can focus on growth.

Messaging

Automate and simply the job for your sales, marketing and support teams with Obermind Platform’s customisable messaging and communication tools. Powerful cross-platform capabilities enable you to manage transactional and marketing communications separate and in compliance with applicable rules and regulations.

Apply our range of E-mail, SMS, mobile in-app, video, voice and browser messaging/communication tools to keep your end-users and in-house teams up-to-date, secure and engaged while enriching your data repository.

Frequently Asked Questions

Are we a good fit? Do let us know if you have more questions.

Why should i choose Obermind?

Excellent question! Well it depends what you are trying to achieve, but we always believe it’s worth having a chat before any fintech project you try to embark on to see what our capabilities are.

White Label Platform:

We can get you off the ground in no-time. And our White label is slightly different from what is out there, we don’t just brand an order management system for you, we have the full ecosystem so you don’t need to add plugins constantly and pay other vendors. Of course you can, but that choice is solely yours. From “bridge”, “CRM”, KYC/AML/KYT, payment systems, admin dashboards, web and mobile apps and so much more – it’s all in place for you to take advantage of.

Custom Fintech Applications:

Here is where you can really get bang for your buck. We have one of the largest fintech code-bases in the market – so imagine how quickly we can build, launch and scale an idea compared to your competition. No guess-work, no performance bottle-necks – we have done it all and just customise to suit your purposes.

We have achieved millions of dollars in savings for our clients. Let’s have a chat and see what we can do for you.

Do I just get some web and mobile interfaces with Obermind?

Great question!

Yes and No. Well it’s up to you.

We have built an entire ecosystem for finance. From execution, order management, transaction management, portfolio valuations, custom algorithmic framework and risk engines to what end-users see like custom charting libraries, functional front-end components, slick user interfaces and so much more.

Can I White Label without any custom development?

Yes! Our platform is ready to get you off the ground quickly. You can then as you scale either customise on your own or with our help.

You can even sub-white label to your partners easily in no time.

How quickly can I setup my new White Label?

Depending on use case it can be a matter of days. If you use our existing payment processors, exchanges/liquidity provider network, then we just need to setup your brand, custom domain, configure your instruments and off you go.

Our team is on stand-by to get you to market as quick as possible.

Can I add new integrations, like liquidity providers, payment gateways, etc?

Of course! You can either instruct us to do it or do it yourself.

The Obermind Platform is an “API & Developer first” operating system.

Reach out and we will help you either with sample code or setup a task for our devs to get it done for you.

The platform seems too extensive, I just need one of your features for now. Possible?

Of course! That’s the beauty of our modular architecture.

Let’s say you just want to launch Payment Cards on your existing app or platform, we will provide either APIs and/or custom apps for that.

Or, say you want to use our extensive liquidity provider network to enhance your existing platform – no problem.

Reach out and tell us your requirements – we’re certain we can get your matters solved.

Can you customise my platform beyond the branding parts?

Definitely! You can either use our team of experienced fintech developers or your own. We can also work together in a team.

No project is too small or too large. Just tell us what you want the platform to do, what changes you need – and our experienced team will help you achieve your goals.

Will I use your mobile apps just like all my competitors?

No!

Obermind is always behind the scenes, your end-users won’t even know who we are.

We will help you publish everything under your own name in the app stores so you achieve the full value from your marketing efforts – not us.

This will help your team manage anything from marketing your own mobile app to having access to user engagement and activity analytics like never before.

I already have my own apps and other platforms. What can I do with Obermind?

We can easily integrate with your existing apps, CRMs, 3rd party platforms, bridges – well anything.

The possibilities are endless – you can then use Obermind as a singular platform for external integrations, or offer another option along-side your other 3rd party platforms.

The main reason our customers come to us is because they want to achieve Value and Ownership. What do we mean by that?

Well, when you use just another White Label, much of the value that you spend your resources on is actually extracted by them. You are left with little or no data, user metrics, traffic value, ability to scale and add or customise features quickly as the market and your users needs evolve. Generally with our competitors, you just stick a logo on an off-the-shelf product. That doesn’t achieve value for your business.

Obermind is the opposite, when you are ready to take on your competitors and extract the full value of your marketing, branding and sales efforts and build IP and value that your stakeholders can monetise on – that’s when Obermind comes into play.

The possibilities are endless – let’s have a chat and see how our team of developers and quants can help you out.

I have my own developers and quants, can they use Obermind?

Definitely. That’s how we built up the platform originally. Use our SDKs, APIs and more to customise anything from algos, components, user interfaces, APIs – well anything you can imagine.

We always build our platform with developers in mind – so reach out to us, let us know what your dev, quant or researchers need – we will guide you further.

Will Obermind host my platform or can I do it myself?

Either way works. There are a few options:

Obermind Cloud:

Quickest and easiest way to get to market. We will spin you up, and handle everything for you so you can focus on your business.

Managed Infrastructure:

Depending on your hosting needs, we custom-build your infrastructure. Cross-connects, co-locations, load balancers, firewalls and more to achieve operational resiliency and efficiency.

On-Premises:

You and your in-house team can host and manage the platform completely on-prem. We will provide you with the training and support needed to ensure best possible performance.

I don't have a regulatory license. Can you help?

We are a technology development company, so we don’t act as liquidity provider or licensing entity – we are completely agnostic.

However, we have a large global network of clients and partners that we can connect you with to get your business launched quickly.

Can you provide liquidity to my platform?

We are a technology development company, so we don’t act as liquidity provider or licensing entity – we are completely agnostic.

However, we have decades of experience as market makers, so we can help you devise sell- and buy-side algorithms, help you automate risk management, liquidity management and much more.

We also have a vast network of exchanges and liquidity providers with different specialities we can help connect you with.

I have a brand new idea idea and I need to get my MVP out quickly.

We can get your MVP built quickly on Obermind. No reinventing wheels, wasting time and resources or wire-framing, integrations, design or performance fixes – let’s focus on gettting your idea down, customise UI’s and backend and get it out before your competitors.

Will I get source code?

We will work with you to build, scale and protect your business, whatever your budget is – we are here to help you scale.

We can license in many different ways, perpetual license, front-end source code, algo source code or extensive source code (or even source code escrow to ensure business continuity). We want you to build a valuable business with the IP, security and value you need.

We also have plenty of source code we provide you for free – sample sell-side and buy-side algos, integration code with FIX and REST API providers to help you and your team get on with your business.

Reach out and tell us your requirements.